Understanding Reassessment

Gallery Contents

- Who are we? What do we do?

- Why do we reassess property?

- What are the appraisers looking at?

- Why do we review building permits?

- What happens after your property is reviewed?

- Why aren't all properties adjusted the same amount?

- What happened to assessments over times?

- Where are your taxes going?

Who are we? What do we do?

The City of St. Louis Assessor directs a team of highly skilled appraisers, managers, and analysts responsible for accurately identifying, appraising, and classifying all taxable property.

Why do we reassess property?

By periodically reassessing all properties, the tax burden is fairly and equitably distributed and adjusts as the local market values change.

If properties of different market value all pay the same amount of taxes, the burden is not fairly distributed and properties with a higher market value pay the same amount as those with a lower market value.

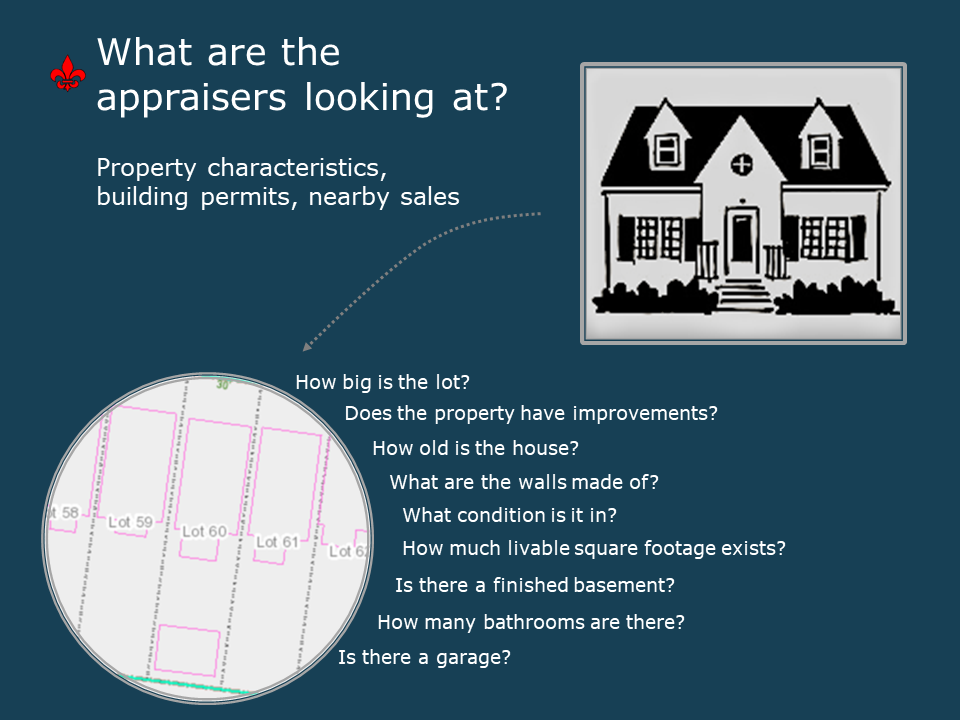

What are the appraisers looking at?

Appraisers physically inspect properties and gather market data in an effort to ensure we have the most up to date information available.

Why do we review building permits?

Building permits are one of the available resources appraisers use when determining whether a change to the property affects its value.

What happens after your property is reviewed?

A mass appraisal system allows the Assessor's Office to compare large groups of properties with recent sales and adjust values to bring in line with the market.

Why aren't all properties adjusted the same amount?

No two properties are exactly the same.

The Assessor's Office must consider all factors when settling a value. New construction, damage or deterioration, and external neighborhood changes influence a property's value.

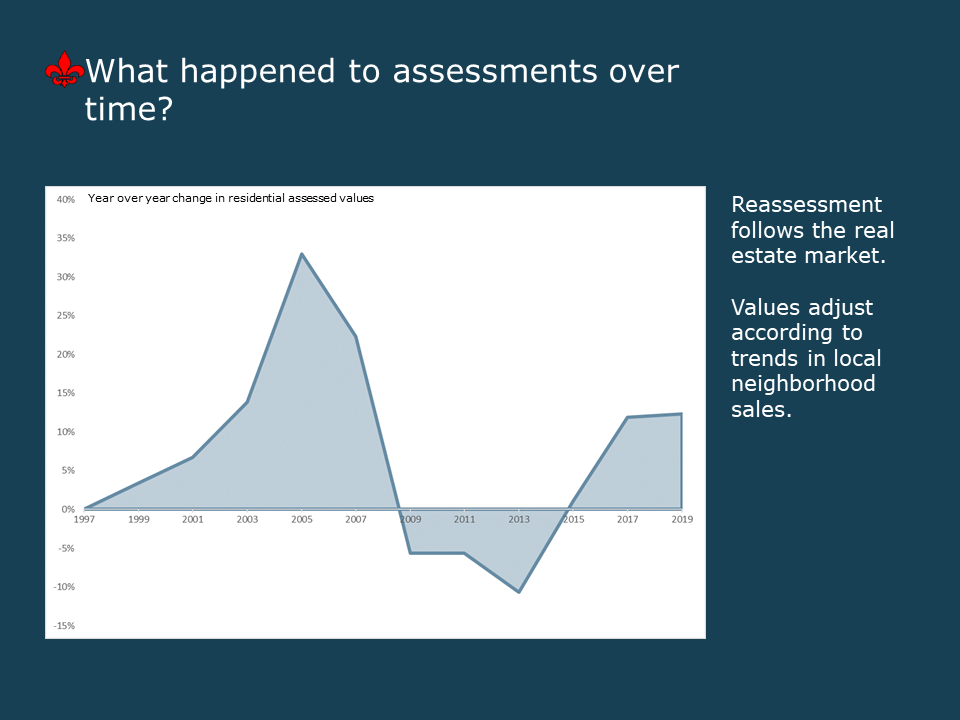

What happened to assessments over times?

Depending on the market at each reassessment date, overall property values may rise, fall, or hold steady.

Where are your taxes going?

Property taxes are local taxes that pay for local services. The City government does not collect or use all of the property taxes. Rather, about 19% of property taxes paid are used by the City government.

More Photos and Videos

View all videos and photo galleries