Property Tax Rates

Overview

Property tax rates are amounts per $100 of assessed value on a piece of property. This rate applies to personal property as well as real property. Commercial real property, however, includes an additional sur tax of $1.64 per $100 of assessed value.

How Taxes Are Determined

Political subdivisions (like school districts and libraries) are given the power of taxation by the state. Many other special districts and programs exist within the City that may add an additional amount to a tax bill.

Role of the Assessor's Office

The Assessor does not determine or set the tax rates charged by the political subdivisions. Missouri law separates the Assessor's authority to value property and the districts' authority to set a tax rate.

How Taxes are Distributed

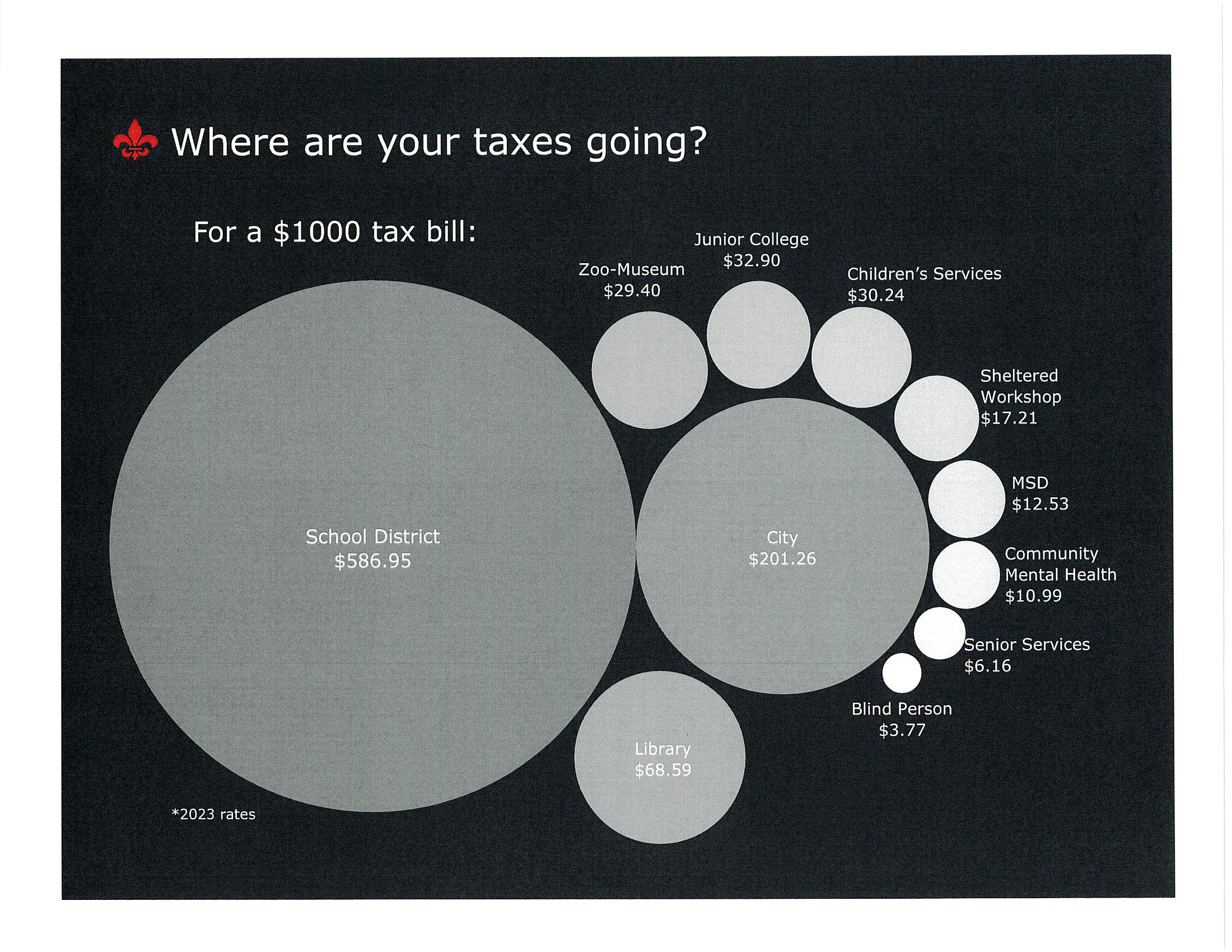

In 2023, the tax rate was set at $7.9593 and distributed as follows:

- School District: $4.6717

- City: $1.6019

- Library: $0.5459

- Zoo-Museum District: $0.2340

- Junior College: $0.2619

- Children's Services: $0.2407

- Sheltered Workshop: $0.1370

- Metropolitan Sewer District: $0.0997

- Mental Health Services: $0.0875

- Senior Services: $0.0490

- Blind Person Fund: $.03

*Follow the links for more information on an individual district.

2023 Tax Rate Break-Out for a $1000 Tax Bill

Historic Tax Rates

Help Us Improve This Page

Did you notice an error? Is there information that you expected to find on this page, but didn't? Let us know below, and we'll work on it.

Feedback is anonymous.