Earnings Tax Department

The Earnings Tax Department is responsible for collecting all payroll and earnings taxes due to the City of St. Louis.

Get Started

Important Dates

For individuals, earnings taxes are due by April 15th of each year.

For businesses, a calendar year return must be filed on or before April 15th, while fiscal year returns must be filed within 105 calendar days of the close of the fiscal year.

Payroll expense taxes and employer withholding of earnings taxes are due each quarter:

| January 31 | Fourth Quarter |

|---|---|

| April 30 | First Quarter |

| July 31 | Second Quarter |

| October 31 | Third Quarter |

Earnings Tax Information

Business Earnings Tax Information

Information about the business earnings tax in the City of St. Louis, tax rates, due dates and more.

Earnings Tax Forms and Documents

Documents and forms regarding the City's earnings tax

Employer Withholding and Payroll Expense Tax Information

Information about the payroll expense tax and employer withholding of earnings tax in the City of St. Louis

Individual Earnings Tax Information

Information about the individual earnings tax in the City of St. Louis, tax rates, due dates and more.

Taxable and Non-Taxable Items

A list of taxable and non-taxable items for individuals and businesses filing Earnings Tax

W-2 Reporting Specifications

Reporting specifications for employers or payroll companies that need to file W-2 forms with the Collector of Revenue

constituentServices

About Earnings Tax

The one percent earnings tax is collected from:

The one percent earnings tax is collected from:

- Residents of the City of St. Louis, regardless of the location of their employer.

- Employees of businesses located or performing work/services within the City of St. Louis, regardless of where they live.

The City of St. Louis is the sole recipient of the earnings tax revenue collected. The funds collected from the earnings tax are distributed to the City of St. Louis in the following ways:

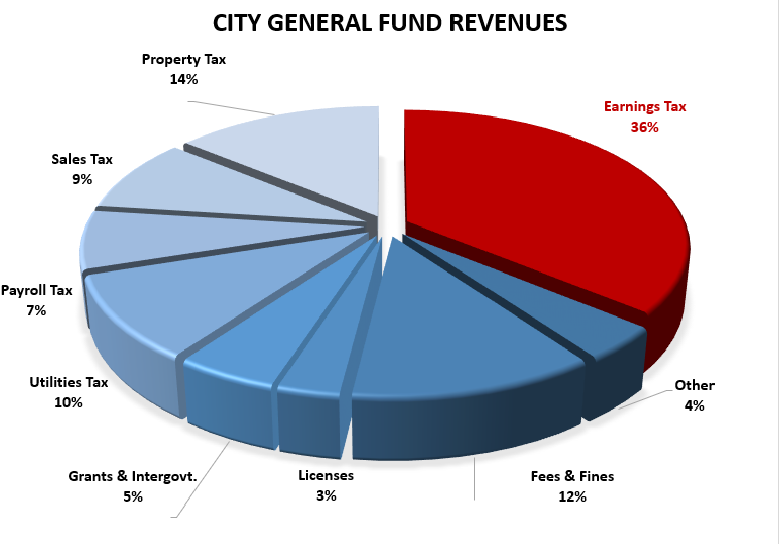

- Earnings tax makes up 36% of the general revenue for our city.

- Earnings tax revenue provides critical resources for our city – street repair, fire and police services, lighting, forestry, neighborhood stabilization services and more.

- Earnings tax revenue ensures that important city services are maintained - sporting events, parks, museums, and the Arch.

Read more about city general fund revenues.

Services

- File Business Earnings Taxes Instructions for city businesses on how to file City of St. Louis business earnings taxes.

- File Individual Earnings Taxes Instructions for city residents on how to file City of St. Louis earnings taxes.

- Open an Earnings Tax Account Information on how to open an earnings tax account with the Collector of Revenue

Contact Numbers

Payroll Expense and Withholding Tax - (314) 622-4071

Withholding & Reconciliation - (314) 622-4805

Business Returns - (314) 622-3296

New Accounts - (314) 622-3291

Court Section - (314) 622-4276

Individual Earnings Tax-Refund - (314) 641-8455

Individual Earnings Tax - (314) 622-4403

Earnings Tax City Codes

Earnings Tax Department Menu

Contact Information

Email: earningstaxcor@stlouis-mo.gov

Phone:

(314) 622-3291

Fax:

(314) 622-4847

Hours:

Monday-Friday, 8:00 AM – 5:00 PM

Address:

1200 Market Street

, City Hall, Room 410

St. Louis, Missouri 63103

Help Us Improve This Page

Did you notice an error? Is there information that you expected to find on this page, but didn't? Let us know below, and we'll work on it.

Feedback is anonymous.